Note: This post reflects developments and legislation as of July 31, 2025. As crypto policy is evolving quickly, some details may change after this date.

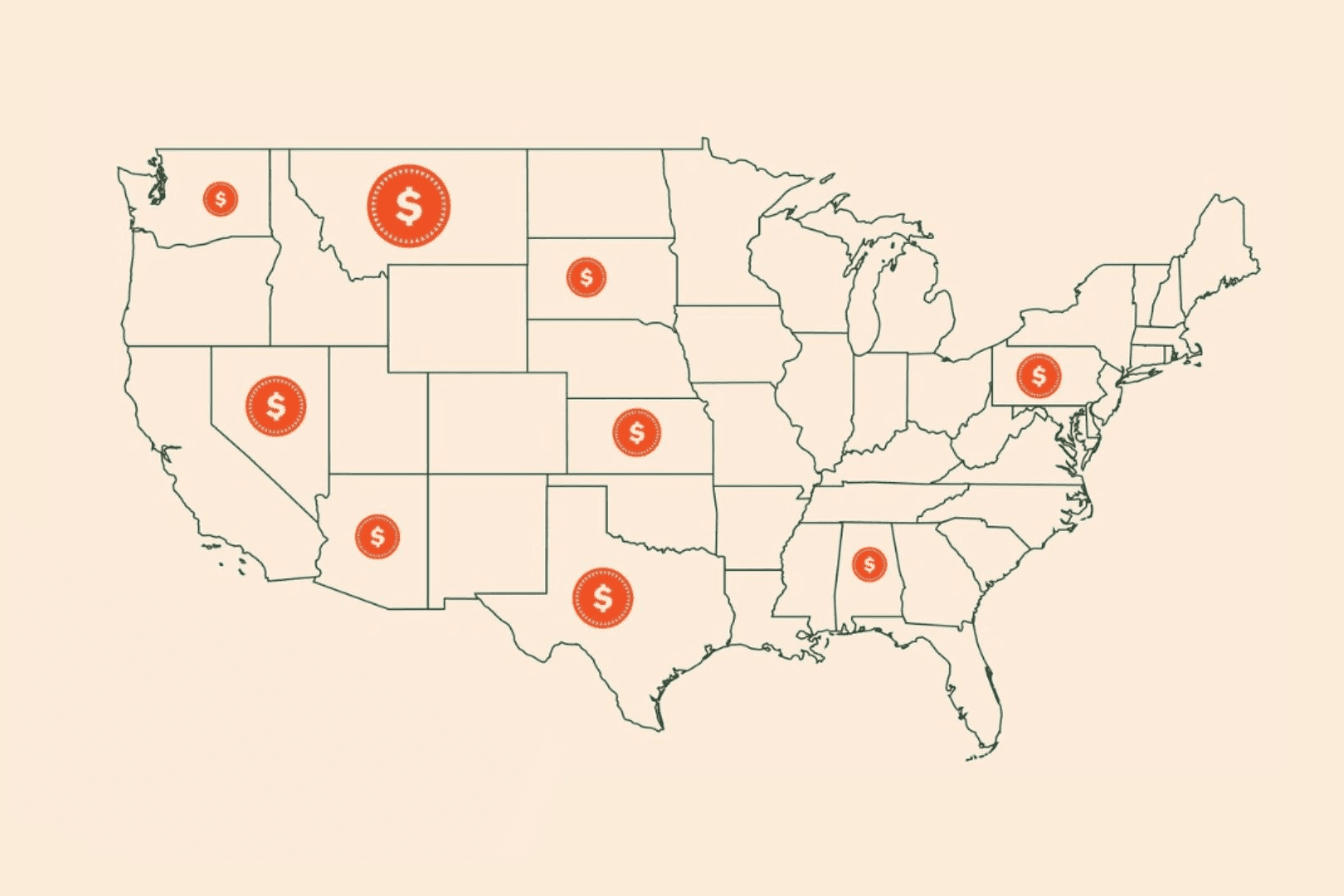

Crypto momentum is growing across the country. As federal crypto laws move forward in Washington, state governments are also developing crypto frameworks. This shows a coordinated effort at both levels to shape the future of digital assets.

There have been 160 crypto-related bills introduced by 48 states. Addressing payments, taxes, budgets, and record keeping.

Most states are moving in similar ways, matching the direction of federal policy.

States are holding crypto

New Hampshire became the first state to allow its government to buy and hold Bitcoin as an investment, and up to 5% of state funds can now be invested into digital assets. Texas passed a similar bill creating a strategic Bitcoin reserve. Think of it like a savings account but instead of dollars, they’re holding crypto. Illinois, Michigan, and Pennsylvania also have proposals seeking to establish a Bitcoin Strategic Reserve and diversify their financial holdings.

This activity builds on recent federal progress. A March executive order laid the groundwork for a national Bitcoin reserve. The CLARITY Act and Anti-CBDC Surveillance Act have passed the U.S. House of Representatives, and the GENIUS Act became law this month. Most recently, the White House released a major report outlining its approach to crypto policy in the U.S. These show an effort in Washington to create clear rules for crypto.

States are moving with federal laws, exploring how crypto can fit into long-term financial planning. What’s important is that these decisions are made by the same boards that manage teacher pensions, emergency funds, and other public investments. This shows that crypto is increasingly being seen as a serious tool for how governments manage and protect public funds.

Governments are accepting crypto for payment

Louisiana became the first state to let residents pay government fees with crypto so property taxes, business licenses, motor vehicle registration, and more are payable with digital assets.

The system works as easy as paying with a credit card. Residents pay with crypto, and a payment processor instantly converts it into dollars so the state receives the exact amount it’s owed. This gives residents another fast, easy, and cost-effective way to pay.

Ohio is launching a similar program this fall while California approved a five-year pilot program starting in 2026. The appeal is practical: lower processing fees and more payment options for residents, which means funds get to where they need to go faster, governments can operate more efficiently, and there are more ways for residents to participate.

States are setting the rules for crypto

Oklahoma passed a "Bitcoin Rights" bill saying yes, you can hold crypto without special licenses and transact with coins freely. Kentucky, Montana, and Utah have similar laws protecting holding and using Bitcoin as basic property rights.

Wyoming has taken its crypto leadership further: the state now lets crypto companies apply for a special state banking license, allowing them to offer services like a financial institution. It’s also preparing to launch a state-backed stablecoin around August 2025.

Final thoughts

Federal agencies continue to shape national crypto rules as states move ahead with implementation. They’re already putting ideas into action, from accepting tax payments in digital assets to protecting everyday crypto ownership and use.

Crypto is becoming part of how local governments operate. Three quarters of holders believe it is important for America to have clear crypto laws, and 73% believe it's important for the U.S. to become the global leader in crypto.

These early steps give policymakers something valuable: real-world examples of crypto in action. State programs are already demonstrating how crypto fits into daily life.

For more plain-English explainers, keep exploring the National Cryptocurrency Association’s learning hub.